The north: rental cost raise by 6%

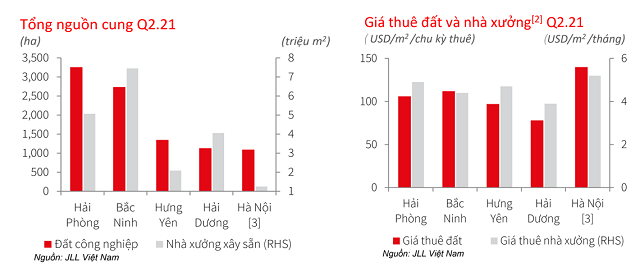

Regarding to the report of JLL in the second quarter, the industrial park (KCN) market for rent in the north recorded more new rental areas from industrial estates in Yen My, Hung Yen of Viglacera Yen My. Total leased area of industrial zones in the north has been expanded 9.700 hectares. Investors Viglacera also plansto construct Thuan Thanh I Industrial park in Bac Ninh this year.

Information of industrial park market in the north.

Rental charges of industrial zones rose 5,9% with the same period last year but increase slowly compared to the first quarter, gained 107 USD/m2. JLL interpreted the industrial parks in Bac Ninh and Bac Giang have to break off manufacturing due to the pandemic which restrained an increase in the rental charges.

The report pointed out that the outbreak of the pandemic made the Northern market calmer as well, not receiving any outstanding FDI projects, but mainly small-scale. The occupancy rate remains at 75%.

JLL expects that Pegatron's increase in investment capital in Vietnam after the project in Hai Phong is a positive signal about the demand for industrial real estate in the future. Outside of the Red River Delta, provinces in the Northeast such as Bac Giang, Quang Ninh and Thai Nguyen are capturing the attention of investors with the advantage of rental prices, and the infrastructure becomes completely. Land prices in these areas are forecast to continue to grow at 8-10% compared to the same period last year.

The south: rental cost increase over 7%

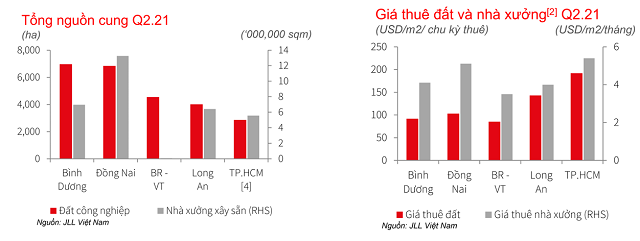

The market in the south recorded a new supplement from KCN Tran An Tan Phu in Duc Hoa District, Long An Province where Tran Anh Group is an investor. This project enhances the total area of industrial land for leasing in the south to 25.220 hectares. Long An becomes an attractive point to invest in besides the two most historic provinces are Binh Duong and Dong Nai.

Information of industrial park market in the south.

The report recorded that many transactions are completed in Ba Ria- Vung Tau, despite the pandemic outbreak, the agreement of land leasing mainly came from heavy industry manufacturers who stand in need of a large land fund. The occupancy rate of KCN reached 85%. New transactions implemented while the pandemic burst shows that investors and lessors step by step find out the concomitant solution with the epidemic to continue operating.

Rent for leasing set an average price peak of 113 USD/m2, increasing 7,1% compared to the same period last year. JLL supposes land rental will progress because of constantly improving infrastructure, typically projects of Phan Thiet - Dau Giay thoroughfare, Bien Hoa – Vùng Tau expressway, Ben Luc – Long Thanh highway, which located in the key market of the industrial park around Ho Chi Minh City.

Source: NDH Newspaper